Medicare Tax Rate 2025 - Medicare Tax Increase 2025 Donny Genevra, You’re responsible for paying half of this total medicare tax amount (1.45%) and your employer is responsible for the other. Employer Fica And Medicare Rates 2025 Chart Nelle Yalonda, What is the medicare tax rate?

Medicare Tax Increase 2025 Donny Genevra, You’re responsible for paying half of this total medicare tax amount (1.45%) and your employer is responsible for the other.

What Will Irmaa Brackets Be In 2025 Delila Chrystel, The annual deductible for all medicare part b beneficiaries will be $240 in 2025, is $14 more than the 2023 deductible of $226.

The 2025 Medicare TaxIRMAAHigh People YouTube, You’ll pay more if you’re a high.

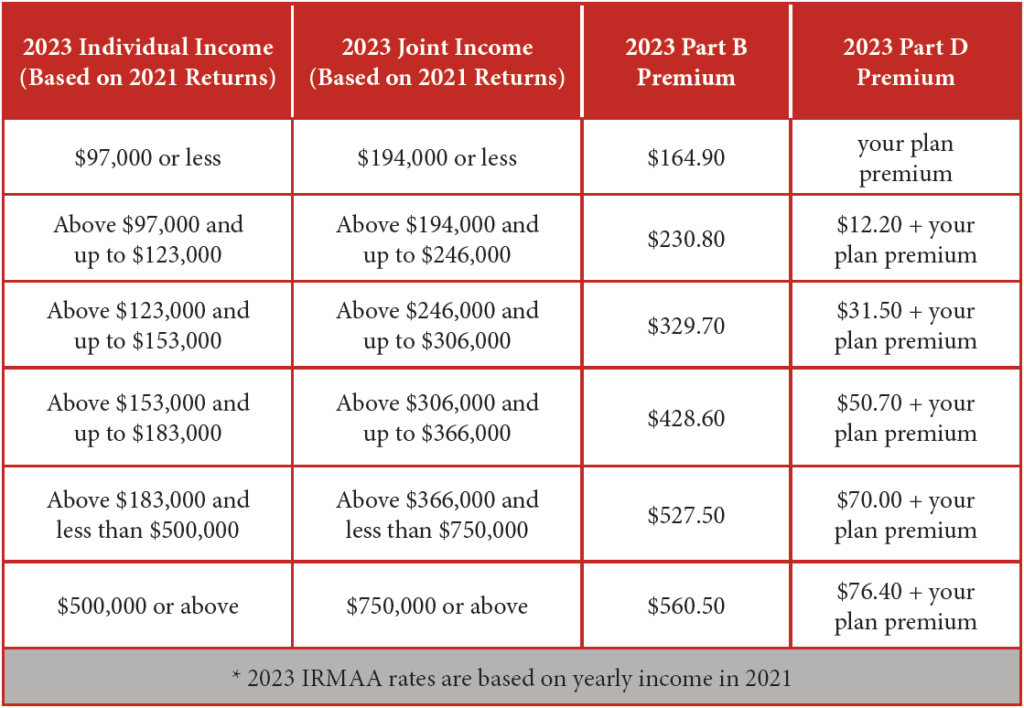

Medicare Irmaa 2025 Brackets And Premiums Tani Quentin, For 2025, beneficiaries whose 2025 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a total premium amount ranging from $244.60.

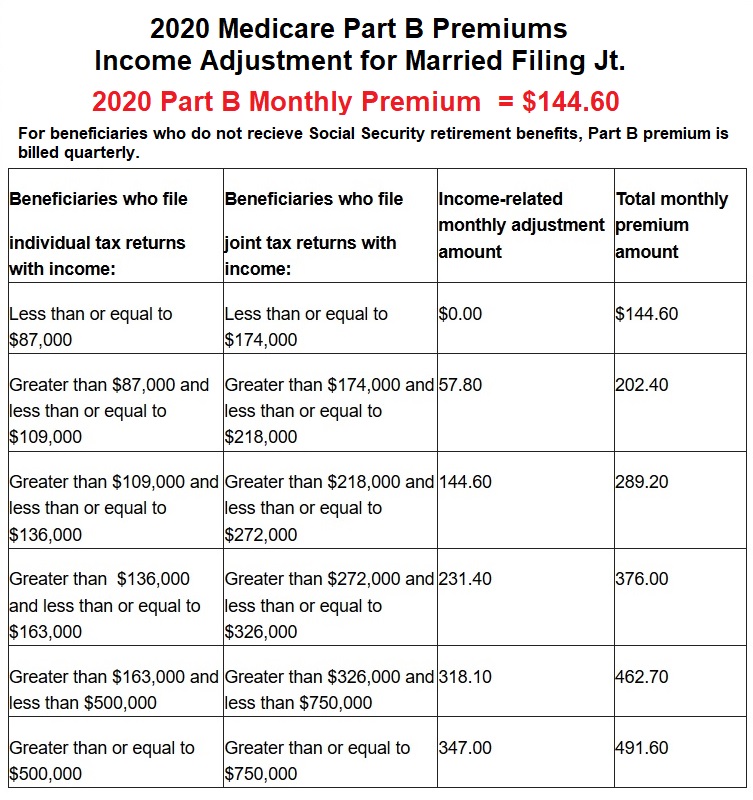

There is no limit on the amount of earnings. Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act.

Fica And Medicare Tax Rates 2025 Adara, Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act.

Medicare Tax Rate 2025. This number is the basis for fica taxation. The social security wage base limit is.

2025 Medicare Tax Rates And Limits Flori Jillane, Social security and medicare tax for 2025.

Medicare Limits 2025 Chart Pdf Licha Othilie, The annual deductible for all medicare part b beneficiaries will be $240 in 2025, is $14 more than the 2023 deductible of $226.

What Is Medicare Tax? Definitions, Rates and Calculations ValuePenguin, In this review, we outline how much the medicare tax rate is in 2025, how it’s calculated and whether you might be exempt from paying it.